1031 exchange calculator

This estimator is provided to illustrate potential taxes to be paid in a taxable sale versus a 1031 exchange. Build Your Diversified Portfolio Of Institutional Real Estate Using IRC 1031 Exchanges.

What Is A 1031 Exchange Asset Preservation Inc

Net amount for Reinvestment.

. Use this calculator to help you determine the deadlines for the 45-Day Identification Period and the 180. Enter the following information and our calculator will provide you an idea of how a 1031. Whether you are an experienced commercial real estate investor or just beginning you will find 1031 exchange expert David Moores videos articles and newsletters a great resource.

And the property or. This simplified estimator is for example purposes only. Well be happy to help you with calculating your 1031 Exchange please give us a call 215-489-3800.

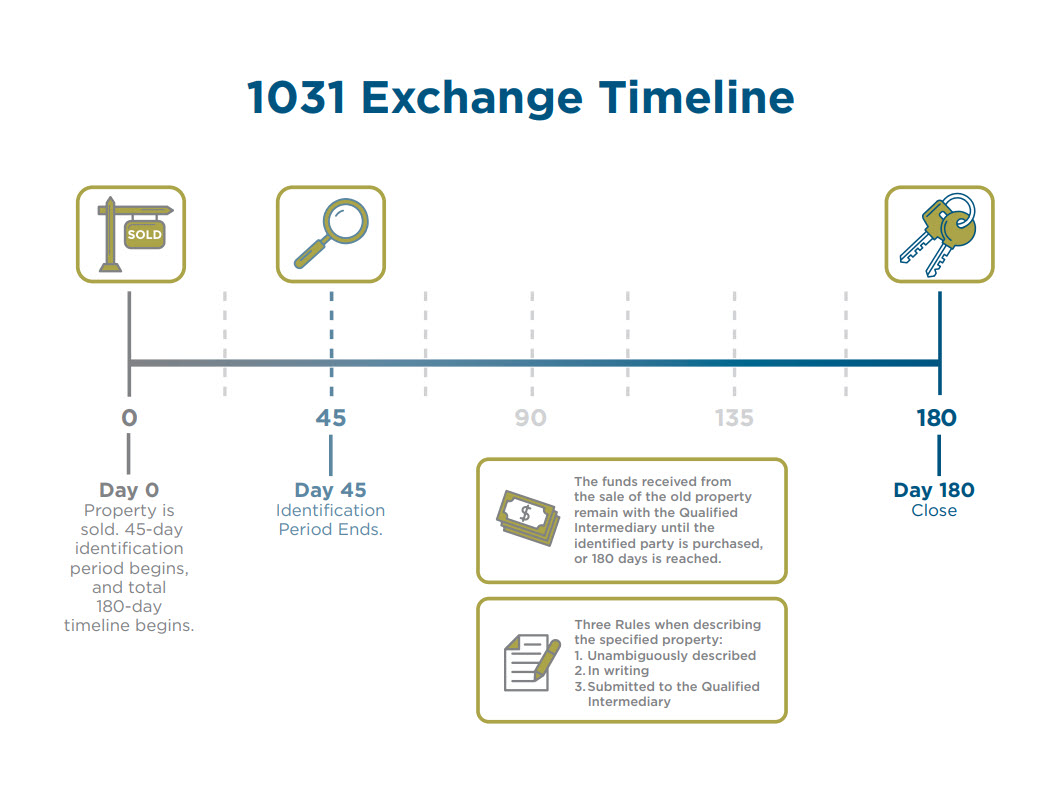

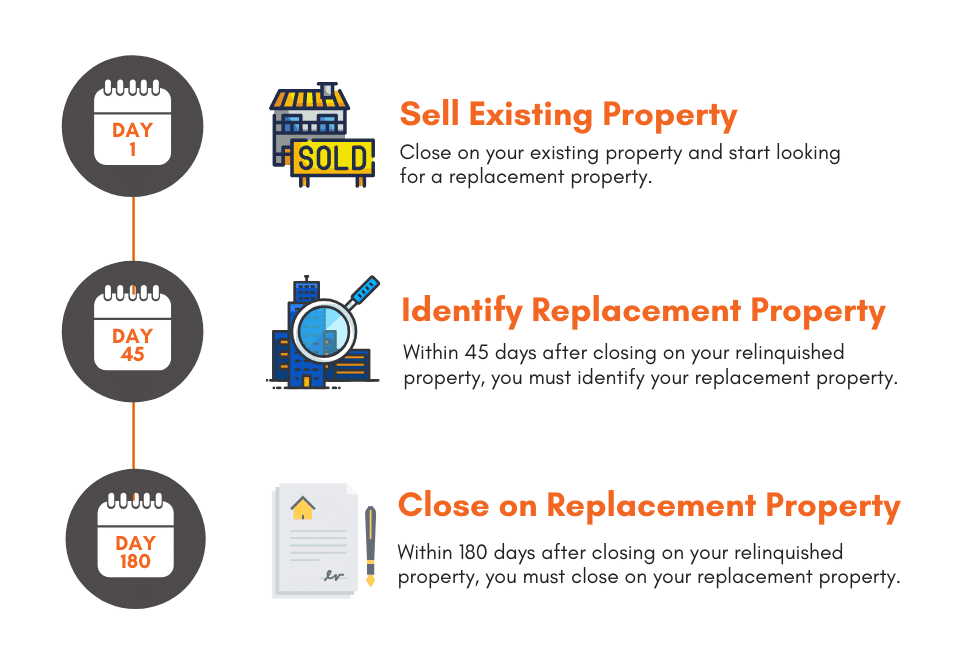

Ad With Decades Of Experience Let Cornerstone Help With Your 1031 Exchange Today. You must formally identify potential replacement properties within 45 calendar days from sale. 1031 Exchange Deadline Calculator.

If the investor does not move forward with an exchange then the transfer of property is a sale subject to taxation. Enter values in the fields shown below to calculate the tax savings of a forward 1031 exchange. The professionals at Liberty 1031 Exchange will show you how a 1031 exchange empowers you to move from investment to investment while keeping your equity intact.

Defer Your Tax Liability Instead of facing taxes of a third or more on your gain with a sale of your investment property put that money into a new investment with a 1031 exchange. Equity Advantage has some of the best 1031 online tools and resources including our popular Frequently Asked Questions page and Capital Gains calculator. 180-day Period Ends on.

A 1031 Exchange requires meeting very strict deadlines for successful completion. Federal Capital Gains Tax Rate 0 15 or 20. Personal Tax Information Enter your capital gains tax rate below.

Since the calculation of taxes involves many factors and your individual situation may require additional variables not included in this illustration. An investor that holds property longer than 1. Under Section 1031 taxpayers can postpone paying this tax if they reinvest the profit in similar property.

Doing so is known as a like-kind exchange which allows taxpayers to grow their. In performing a 1031 exchange one must speak to and. Please enter relinquished sale date below and click Calculate 45-day Identification Period ends at midnight of.

The IRS places two timing restrictions on any 1031 exchange. The maximum exchange period from the closing date of your sale of the relinquished property to the purchase or your replacement property is 180 calendar days. This calculator will help you to determine the tax deferment you will realize by performing a 1031 section like-kind exchange rather than a taxable real estate sale.

The time periods for the 45-day Identification Period and the 180-day Exchange Period are very strict and cannot be extended even if the 45th day or 180th day falls on a Saturday Sunday or. Use our exchange date calculator tool to determine your identification and closing deadlines to help you plan your 1031 exchange. The projections or other information generated by the 1031 Exchange Analysis Calculator regarding the likelihood of various investment outcomes are hypothetical in nature.

This calculator assumes the value of the current property is greater than or equal to the orginal purchase price.

1031 Exchange Explained What Is A 1031 Exchange

Deadline Calculator For 1031 Exchanges

1031 Exchange Calculator With Answers To 16 Faqs Internal Revenue Code Simplified

1031 Exchange Calculator Estimate Tax Savings Reinvestment

1031 Exchange Overview And Analysis Tool Updated Apr 2022 Adventures In Cre

Learn The True Time Frame For A 1031 Exchange

What If Your 1031 Exchange Extends Beyond Your Tax Due Date 1031 Exchange Experts Equity Advantage

What Is A Starker Exchange 1031 Exchange Experts Equity Advantage

1031 Exchange Capital Gains Tax Calculator Midland 1031

![]()

1031 Exchange How It Can Work For Your Properties

1031 Exchange Timeline Overview And Considerations Accruit

1031 Exchange Rules Real Estate Transition Solutions

45 180 Day Exchange Calculator 1031 Crowdfunding

1031 Exchange Calculator Ramen Retirement

1031 Exchange Savings Calculator

Financing Archives Norada Real Estate Investments

How To Do A 1031 Exchange Like A Pro Free Guide